“The task is not so much to see what no one has yet seen; but to think what nobody has yet thought, about that which everybody sees.”

A Wall Street Journal editorial entitled “Schrödinger’s Recession” appropriately describes the financial landscape today. The article compares the state of the economy to a famous thought experiment published in 1935 by Nobel Prize-winning Austrian physicist Erwin Schrödinger. Schrödinger’s hypothetical exercise begins with an imaginary cat placed inside a metal box which contains a small vial of potentially deadly radioactive material. Eventually—though not at any pre-determined point—the harmful substance eats through the vial and becomes exposed to the cat. Until the box is opened, however, an observer cannot know for certain whether the cat is still alive. Schrödinger theorized (based on a school of thought known as the Copenhagen interpretation of quantum mechanics) that the cat can be simultaneously dead and alive as long as the box remains sealed. This idea is referred to as “the observer’s paradox,” and it provides a near-perfect illustration of the current economic environment.

“The economy is like Schrödinger’s cat,” writes the author of the Wall Street Journal article referenced before. “Its status is knowable only after the fact. You can’t say for sure whether a recession is happening until seven months or so after it begins. With any luck, the second half of this year will be better than the rocky first half. The Federal Reserve chief hopes that is the case. So does [the President]. For the rest of us mere mortals, it feels like the pain is getting worse.” While this excerpt precisely captures present-day financial market sentiment, surprisingly, it was written in May of 2008 during the Great Financial Crisis (GFC). It serves as a reminder of Mark Twain’s famous observation that, “History never repeats itself, but it does rhyme.”

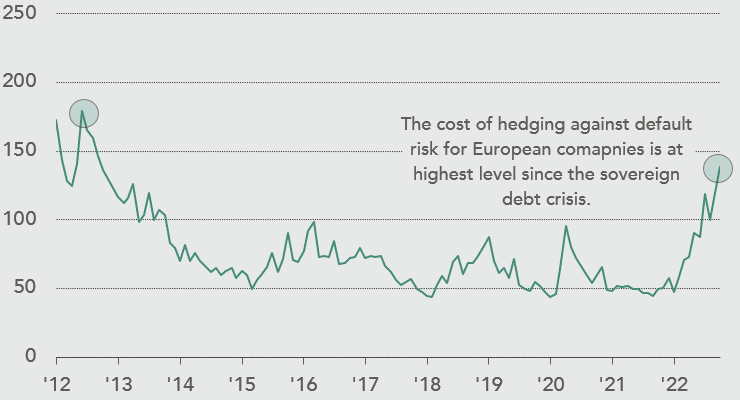

Source: Charles Schwab, Bloomberg, as of 9/29/2022. Indexes are neither managed, nor incur management fees, costs, or expenses. They cannot be invested in directly. Past performance is no guarantee of future results.

“The Observer’s Paradox” Exists in Today’s Market

Many market participants argue that “the cat is dead.” They believe asset values will decline further as economic turmoil continues. Meanwhile, others (likely a much smaller group) think “the cat is alive”; they feel as though asset prices have overly discounted negative news and will begin to recover once the economy resets. Markets exist in a state of uncertainty with opposing evidence supporting both claims.

Below are some data points suggesting that “the cat” (financial markets) could be both dead and alive at the same time. A dead cat means we need to remain defensive, whereas an alive cat means we should be investing aggressively and opportunistically.

Stay up to date

Subscribe to receive our quarterly investor letters and market updates.

Reasons Why the Cat is Dead: Stay Defensive

- Consumer Delinquencies Starting to Tick up: Subprime auto loan delinquency rates, typically the first subsegment to show weakness in a slowing economy, rose by 430bps off the low in 2021 to almost 14% today. – Piper Sandler

- Investor Sentiment Remains Horrible: This is the first time since 1987 that AAII Bearish sentiment has remained above 60% for two weeks in a row.

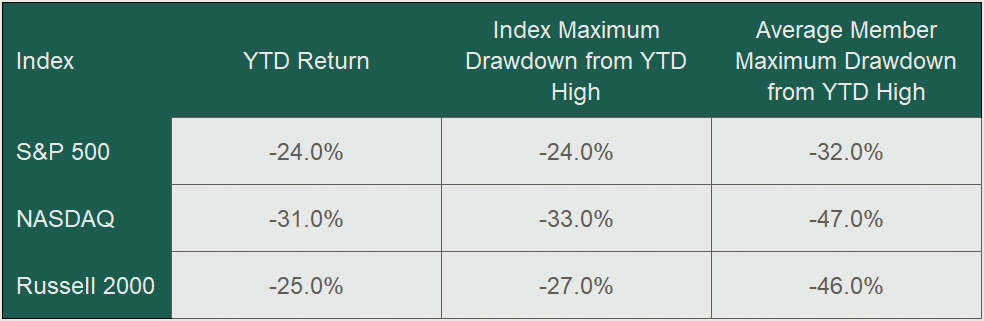

- Dollar’s Strength Creating International Problems: (CHART 1) “According to the Bank of International Settlements’ Real Effective Exchange Rate model, the dollar looks more expensive than in all but two events in the last 51 years – the levels in 1971 that signified the end of the Bretton Woods Agreement and the mid-1980’s dollar bubble that led to the Plaza Accord.” – GMO

- Roughly 40% of S&P 500 earnings originate from overseas.

- IPO Activity is Non-Existent: “U.S. IPO volumes are down 94% y/y, with just $7bn raised so far in 2022.” – Dealogic

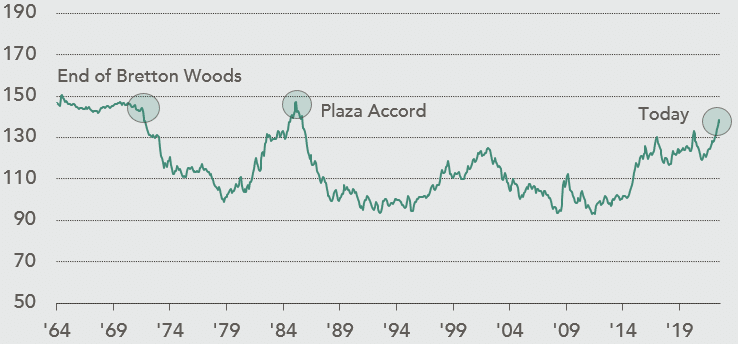

- Extreme Bond Market Volatility: (CHART 2) The Ice BofA MOVE Index, which tracks fixed income market volatility for U.S. Treasuries, has reached its highest level since the GFC in 2008.

CHART 1: U.S. Dollar Real Effective Exchange Rate

Source: GMO, Bank of International Settlements. Data through Aug. 31st, 2022.

CHART 2: U.S. Treasury Volatility

Source: Ice BofA MOVE Index, Bloomberg. Data through Sep. 28th, 2022.

- Housing Bust on the Horizon: According to the National Association of Home Builders, mortgage refinancing activity is down 82% vs. a year ago and applications to buy a home are 19% lower.

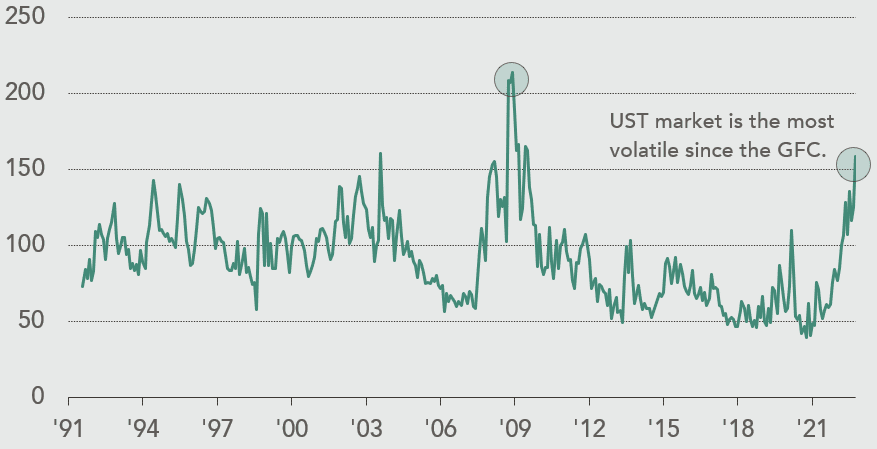

- Europe Default Risk is at Extremes: (CHART 3) The iTraxx Europe Index of investment-grade credit default swaps (CDS) topped 142 basis points to hit its highest level since September 2012, when the markets were concerned about a European sovereign debt default.

CHART 3: Itraxx Europe Bond Index CDS Spreads

Source: Bloomberg. Data through Sep. 29th, 2022.

- Global PMIs are Contracting in Unison: “The percentage of Global PMIs below 50 has risen from 43% (July) to 57% (September including flash PMIs), indicating the entire global economy is slowing down dramatically.” – PiperSandler

Reasons Why the Cat is Alive: Be Opportunistic

- Employment Remains Strong: The U.S. unemployment rate is 3.6%, the lowest in 30 years.

- S&P 500 Earnings Still Growing: “For Q3 2022, the estimated earnings growth rate for the S&P 500 is 2.9%.” – Factset

- Travel is Booming: The U.S. hotel industry reported record-high monthly room rates on a nominal basis, according to July 2022 data from STR. TSA checkpoint travel numbers still showed significant y/y growth (10-20%) throughout September.

- Lower Gas Prices Helping Consumers: U.S. gasoline prices have fallen for 13 weeks in a row and are now down 26% from the June highs. This is the longest consecutive weekly slide in more than three years.

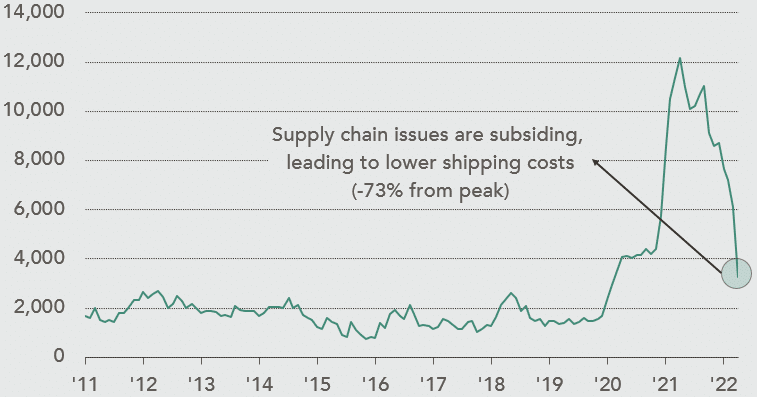

- Shipping Costs Normalizing as Supply Chain Issues Subside: (CHART 4) “A 40-foot shipping box from the world’s largest port of Shanghai to Los Angeles fetched $3,779 last week, the first time the spot price was below $4,000 since September 2020 and half the level of three months ago.” – Bloomberg

CHART 4: WCI Freight Rate Shanghai to Los Angeles (USD/40ft box)

Source: Bloomberg. Data through Sep. 29th, 2022.

- Speculation Mania is Ending: “Trading volumes in nonfungible tokens—digital art and collectibles recorded on blockchains—have tumbled 97% from a record high in January this year. They slid to just $466 million in September from $17 billion at the start of 2022, according to data from Dune Analytics.” – Bloomberg

- Cost of Living Showing Signs of Improvement: Apartment rents are falling from record highs across the U.S. for the first time in nearly two years, after they climbed 23% since August of 2020. Median housing prices declined 1% in August and July, the two biggest declines since January 2009. The biggest price corrections have been in the hottest markets: San Jose, CA is down 13% from peak and San Francisco, CA is down 11%.

- Construction Costs are Subsiding: Lumber prices have fallen 71% from their highs, reaching the lowest level in more than two years.

The Key is Anticipating Changes in Perception

Our bottom-up, fundamental investing approach is not built upon macroeconomic prognostications. Owning resilient businesses that can compound capital for long periods of time is always a sensible strategy—and one which naturally helps mitigate economic uncertainty. We believe one of our greatest qualitative strengths as a firm is not rooted in a superior ability to predict the future, but rather a deep understanding of investor psychology and the ability to recognize when sentiment reaches extreme levels. Discussions surrounding our portfolio almost always include the following two concepts:

- Perceptive Capacity: what information should we be focused on?

- Variant Perception: how is our investment thesis different from consensus?

Opportunities tend to arise when investors reach unanimous agreement about the dangers of a particular risk whose effects may be difficult, if not impossible, to quantify in advance. Right now, there are several such risks including inflation, rising interest rates, recession, and war in Europe. When everyone has their microscopes focused on the same issues all at once, it is easy for analysis to become static. Time horizons shorten, only the worst-case scenarios or comparisons are discussed, and typically great businesses become mis-priced. Ironically, once the cat is officially pronounced dead, investors usually start becoming more sanguine about an impending recovery, and stock prices are normally higher. There is great value in anticipating changes in investor perception, especially during times when the pendulums of valuation and sentiment swing to extreme levels.

Portfolio Commentary

In the last week of the quarter, we deployed roughly 20% of our investors’ cash position into existing portfolio holdings. We view our current set of investments as statistically cheap on both an absolute and relative basis. Additionally, we have several new investment ideas on our short list, and we will opportunistically acquire shares of those companies at the appropriate price. Great investment returns can be generated during periods of uncertainty when perceptions become overly myopic and one-sided, which is exactly what is happening today.

The Nixon Capital Team

Information contained herein has been obtained from sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security. Portfolio holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC. This document has been updated to comply with Rule 206(4)-1(a)(5). Investors may have been provided additional information at the time of publication.