“In my 22 years here, I’ve never been more excited. I’ve also never been more uncertain.”

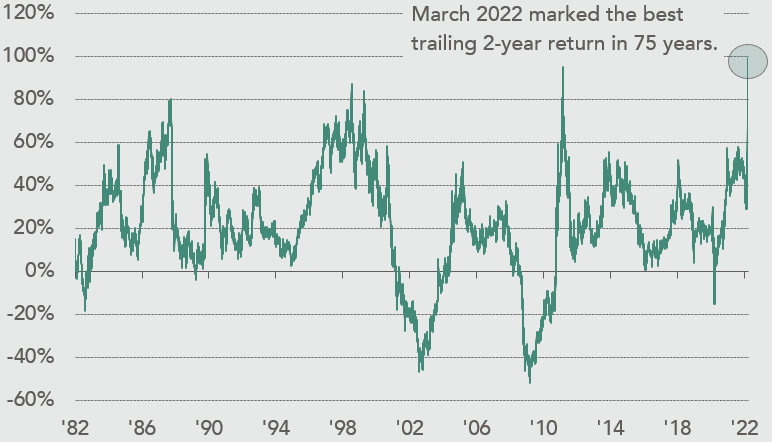

Exactly two years ago, the world declared war on an invisible enemy: COVID-19. Markets collapsed and the S&P 500 index delivered its second worst return to start a year since 1927. From the March 2020 low, the S&P 500 has rebounded nearly 100%, marking the best two-year price performance in over 75 years (CHART 1). But just as one war seemed to be ending, another one began in Eastern Europe. During the first quarter of 2022, the S&P 500 yet again experienced one of the worst starts to a year since 1927 (5th worst to be precise). Geopolitical conflict in Ukraine has exacerbated global inflation, forcing the Federal Reserve to raise interest rates more quickly than previously expected. The market is now pricing in seven quarter-point rate hikes in 2022 compared to just three hikes when we shared our last quarterly letter. Global asset price volatility has been on the rise recently, and it seems as though the inflation hawks are finally coming home to roost.

CHART 1: Rolling 2-year S&P 500 Return

Source: Bloomberg. Data as of Mar. 25th, 2022. Past performance is no guarantee of future results.

According to Sentiment Trader, “The average volatility gauges across markets are in the top 2% of their yearly ranges.” Such an incredibly high correlation across stocks, bonds, currencies, gold, oil, and other asset classes has rarely been witnessed in the last 30 years. We embrace volatility and the opportunities it provides, as rapid price swings usually coincide with sentiment that rests in the tails of extreme fear or extreme greed. However, while sentiment indicators have indeed flashed fear this quarter, valuation parameters are not nearly as compressed as they were two years ago. We therefore believe that using sentiment alone as a contrarian indicator does not adequately capture the full risk/reward landscape.

Valuation spreads in March of 2020 (i.e., the difference between the cheapest quintile of stocks and the market average) reached 4.5 standard deviations above the long-term mean, according to Empirical Research. By comparison, spreads today are not even one standard deviation above their long-term mean. In other words, despite the recent pickup in market volatility, the rift between “expensive growth” stocks and “cheap value” stocks remains well within the realm of normal. That’s not to say there aren’t bargains to be had, but it is an indicator that we haven’t yet reached a valuation pressure point. Furthermore, with demand showing signs of peaking across a multitude of industries, it could take some time for fundamental perceptions to become realigned with reality.

We do not know how the current geopolitical environment will evolve or at what point the market will have fully discounted the Fed’s delayed inflation-fighting mandate. We will remain focused, as always, on analyzing the potential risk/reward of specific investment opportunities, even as macro news continues to drive the broader narrative.

Portfolio Review of Earnings Reports

Although we are constructive on the long-term prospects for our investments, the current macro backdrop is very cloudy. Our management teams are navigating supply chain constraints and mitigating the effects of rising input costs, while at the same time competing for talent in the tightest labor market in decades. We thought some of the commentary below from our management teams was worth sharing:

- “I mean the supply chain; I think many of us thought it would have been — we’d have been caught up by now. I mean we’ll be lucky to be caught up by the end of the year. And because it’s just hitting everybody from all angles, all the raw materials, all the transportation issues, not just the transportation getting it to us. Our vendors having to get all of their components from all over the world shipped to them. So you just have this compounding supply chain kind of puzzle happening.” – Gary Friedman, RH

- “We’ve taken exit costs or any costs that we know from a product cost that would hit in ’22, because we’re talking to our manufacturing partners consistently. That is all baked into our 2022 outlook. So our expectation is, things do not get better, and things aren’t getting significantly worse.” – Paul Carbone, YETI

- “Part of the reason why inventories are up so much year-over-year is we need to make sure we have adequate safety stock. Some of our component suppliers are now quoting us with 52-week lead times, which is clearly not feasible if we have a marine product that needs to be on Bass Pro shelves next week.” – Garmin IR

- “The private independents…people that are growing at 15% to 20% are going to run out of inventory fairly quickly…A lot of companies, a lot of the privates, are experiencing labor issues, cost issues, can’t get equipment, so that’s going to prevent the rig ramp up.” – Scott Sheffield, PXD

- “Listen, it’s a very, very competitive workplace. We lose people to competition. We hire people from competition of all sizes…and we’re very knowledgeable about attrition that’s happening at the company…We never want to lose good people, but it happens.” – Charlie Scharf, WFC

Stay up to date

Subscribe to receive our quarterly investor letters and market updates.

Returns Masking Underlying Stock Price Moves

Our willingness to add to existing holdings that have declined is completely dependent on price. As opportunistic investors, we are by no means waiting for “the dust to clear.” However, we recognize that the probabilities of various outcomes in the short run are as uncertain as they have been in years, and for that reason we are more keen on playing defense until the pendulum swings too far in one direction.

Great businesses have endured the Tech Bust, 9/11, The Great Depression, and The Coronavirus Panic. They will certainly withstand whatever is coming next in 2022. Our goal is to invest opportunistically while structuring the portfolio for both downside protection and upside capture. We thank you for your confidence in us.

The Nixon Capital Team

Information contained herein has been obtained from sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security. Portfolio holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC. This document has been updated to comply with Rule 206(4)-1(a)(5). Investors may have been provided additional information.