“A thing long expected takes the form of the unexpected when at last it comes.”

~ Mark Twain

German economist Horst Siebert originally coined the term “Cobra Effect” to illustrate how unintended consequences can result from well-intentioned solutions. This concept dates to the late 19th century when Delhi was controlled by British rule. Upon takeover of this unfamiliar land, the British government discovered that venomous cobras infested the city. To rid the city of the snakes, Britain set up a bounty program for bringing in dead cobras.

The citizens of Delhi began killing cobras and the intended consequences of the British program showed signs of initial success. However, Delhi citizens were a resourceful group, and began breeding cobras to create an endless supply of bounties and income for themselves. Once the British government discovered this, the program was quickly cancelled. The cobra breeders, realizing their inventory now worthless, released the snakes back into the city. The venomous cobra population became worse than before, thus creating the “Cobra Effect.”

Unintended consequences, especially when financial reward is involved, typically arise from poorly thought-out and simple solutions for tackling complex problems. Humans tend to think linearly and statically (cause-and-effect) when the world is complex and dynamic. A lot of similarities are present today in capital markets.

Inflation is the Cobra and The Fed are the British

Today, the Federal Reserve views inflation as the number one issue negatively impacting their mandate. Monetary policy (via rising rates) has been used to resolve this problem. Similar to the British when faced with an unknown threat, the Federal Reserve responded aggressively to resolve the situation. Instead of gradual, measured rate hikes to observe the potential effect, the Fed has embarked on the fastest rate hike cycle in history to combat the highest inflation since 1981.

The intended consequences of the Fed worked initially as the tightening of credit slowed down the pricing increases seen across homes, food, energy and other goods and services.

The unintended consequences of the Fed’s actions have become significant:

Lending collapses:

- US banks have issued new loans and leases at an annualized rate of $279bln in 2023, down over 40% from the average of $481bln between 2015 and 2019 according to FT.com.

Fewer companies going public:

- In the U.S., IPO proceeds for the first half of 2023 totaled close to $8.3bln. This continued the difficult trend set in 2022 when the number of IPOs was the lowest since 2000, and the proceeds were only 5% of total value of IPOs in all of 2021.

Spike in bankruptcies:

- U.S. Chapter 11 bankruptcy filings jumped 68% in the first half of 2023 versus 2022, with over 2,970 filed.

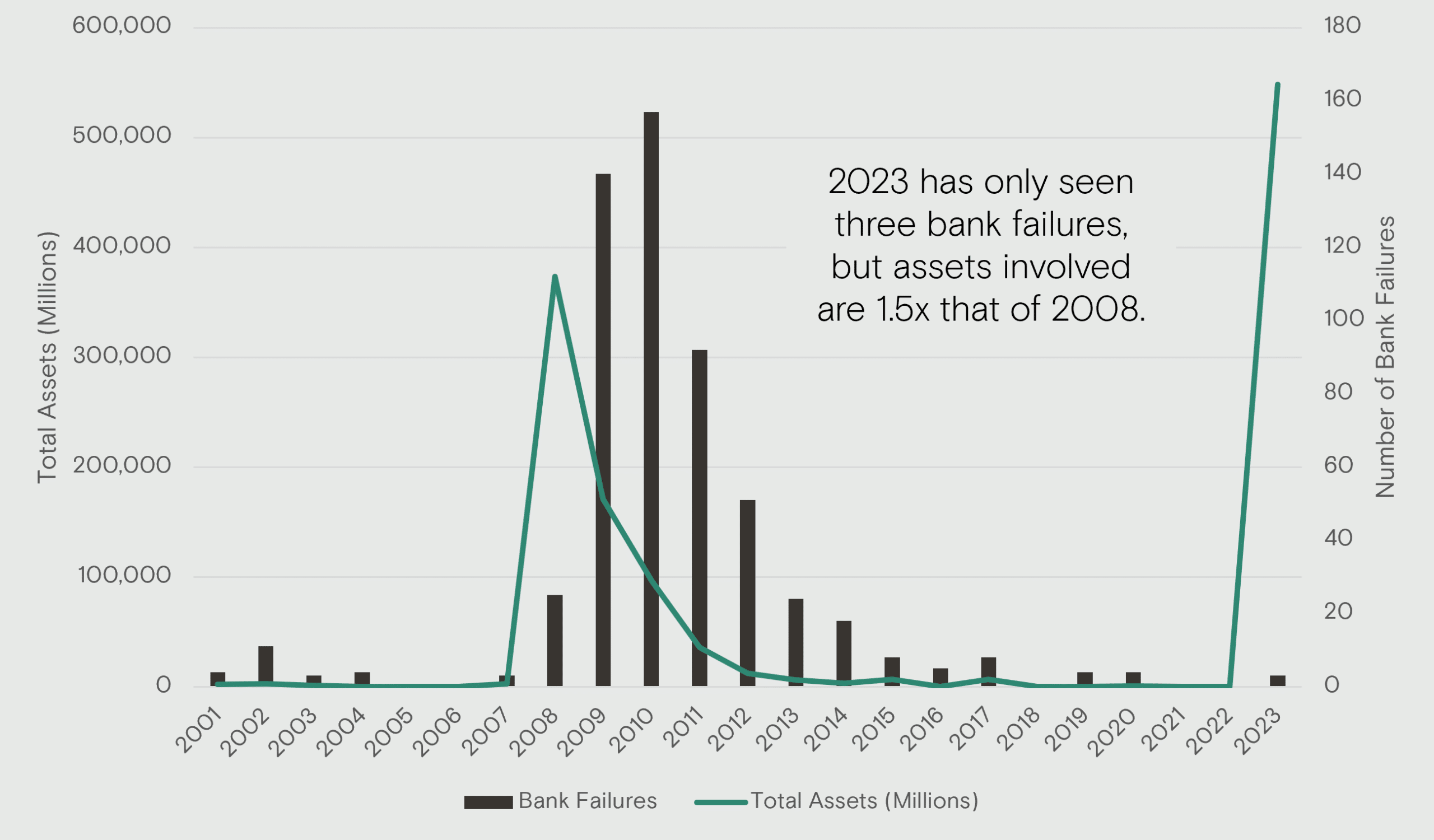

CHART 1, BANK FAILURES IN U.S.

Source: FDIC

Banks failing:

- Three U.S. banks, with over $540bln of assets, failed within weeks of each other. Depositors had to be backstopped by the Treasury, Federal Reserve and the FDIC. Compare this to the Great Financial Crisis (GFC), where the peak total assets of bank failures was $373bln in 2008.

- Outside the U.S., CSFB (a 167-year-old financial institution) failed and had to be backstopped by the Swiss National Bank.

Commercial real estate (CRE) distress:

- The Green Street Commercial Property Price Index, which tracks the pricing of institutional-quality CRE, is down 16% from the March 2022 peak.

- According to MSCI, YTD transaction volumes are down over 60% year over year through May.

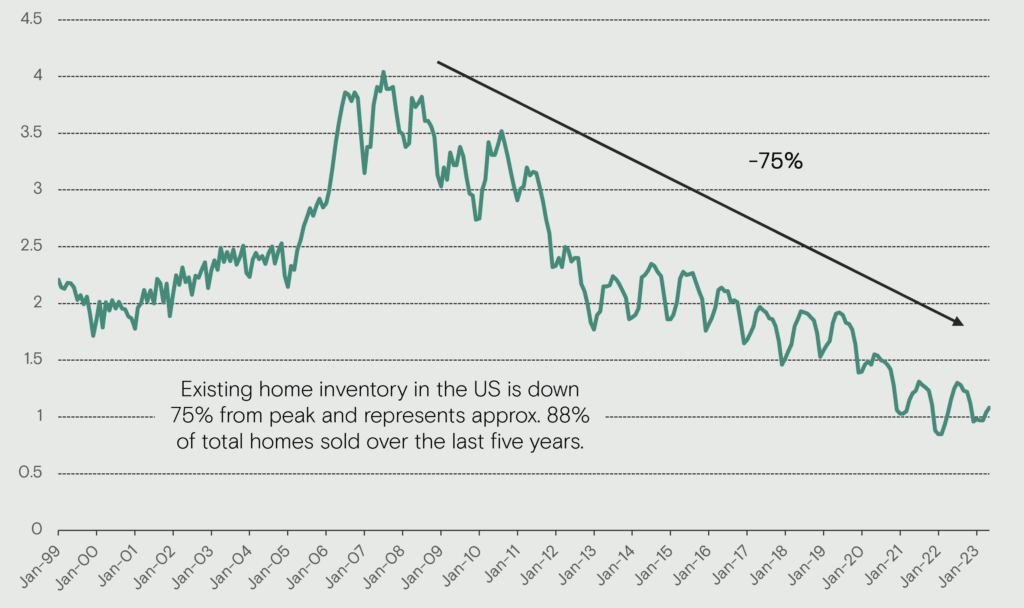

Housing paradox:

- Mortgage rates have more than doubled to over 7% with refinance activity collapsing by over 70% year over year.

- According to Redfin, 62% of mortgage holders have a rate below 4%, and 82% have a rate below 5%. Over 90% of mortgages have a rate below 6% today.

- Total inventory of unsold existing homes is roughly 1mln, ~50% less than what it was in 2019.

CHART 2, U.S. EXISTING HOME INVENTORY (mlns)

Source: Bloomberg

These statistics highlight a deteriorating financial environment without any signs of abating. Therefore, one could make the argument that this is negative overall for equities. However, markets are a discounting mechanism for the future, and have been anticipating this higher interest rate environment for over a year. Like the cobra effect, this situation has created unexpected opportunities for the enterprising investor.

Unexpected Opportunities

Recently, we’ve made two investments in companies with exposure to the auto industry. One is right sizing their cost structure and the other is a large beneficiary of the growth in the electrical vehicle sector. While each company has their own attractive company-specific value creation opportunities, the investment return will improve if the auto sector recovers back to 2019 levels (OEM new car production and used car sales volumes in particular).

Another specific opportunity set lies in the arena of spin-offs. A sizable portion of our portfolio has been invested in these companies for reasons highlighted here. Currently, there are eight spin offs on our radar that will be completed in the next six months. We are also monitoring three recently completed spins that could be compelling opportunities at the right price.

We envision there will be more unexpected opportunities that arise from current market conditions. You should expect more portfolio activity in the coming months should price-to-value relationships present compelling investment opportunities.

Tale of Two Markets

The negative statistics highlighted in this letter would almost certainly imply that equity markets are down. So far, the first half of 2023 has proven the opposite.

As it stands today, the top 10 companies in the S&P 500 combined market cap exceeds $9 trillion, and it is mind-blowing that only one of those companies even existed 50 years ago. The top 10 positions now account for 31.7% of the entire market cap of the index – half of which is three companies alone (AMZN, APPL, and MSFT). The price appreciation has largely been driven by the euphoria around the software developments for ChatGPT and Artificial Intelligence (AI), and the S&P 500 now trades at 19x NTM (next twelve month) earnings. According to Empirical Research, this puts the index in the 88th percentile of P/E ranges since 1976. Seven of the top 10 companies are trading for over 30x NTM earnings, masking the underlying valuation of hundreds of smaller companies. For example, when we exclude the companies who don’t generate net income from the Russell 2000 Value Index, we find that the remaining businesses trade in aggregate for 12.5x NTM earnings, or over 30% cheaper than the S&P 500 on that metric. As John Maynard Keynes famously said:

“Markets can remain irrational longer than you can remain solvent.”

While it’s easy to be fixated on inflation, AI bubbles or extreme valuations, this won’t lead to investment returns. Generating wealth occurs by scouring markets for unexpected opportunities, deploying capital opportunistically, and patiently waiting for value to be recognized. Right now, we are in the season of scouring, which is what we will spend the rest of our summer doing.

The Nixon Capital Team

Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. Information contained herein has been obtained from various sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any reliance placed on opinions and assumptions herein is done at your own risk. Nixon Capital has not reviewed any of the websites that may be linked to this letter and is not responsible for their content. Nixon Capital is not responsible for the privacy practices of such other websites. Discussions of individual securities are intended to inform shareholders as to the basis (in whole or in part) for previously made decisions by the firm to buy, sell or hold a security in a portfolio. References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security. Portfolio holdings and asset allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC.