“There is no barrier for U.S. Treasury yields going below zero.”

Table of Contents:

- Introduction

- What is a negative interest rate?

- Why are so many people talking about negative interest rates?

- What are some explanations for why we could have negative interest rates?

- Why would an investor ever buy a bond with a negative yield?

- What are some of the possible advantages of negative rates?

- What are the potential problems with negative yields?

- Closing Thoughts

Let me get this right…you want me to loan you money AND you want me to pay you to borrow this money from me? Maybe I’m just projecting my own low abilities, but negative interest rates are mind-numbing to think about. Yet, more and more people are talking about the possibility of negative interest rates in the United States. In reality, none of us know how this would work, but here’s my best (non-exhaustive) introduction to the concept. As investors (and just citizens), we really want to focus on the possible problems that could arise from negative rates. This summary attempts to answer six questions:

- What is a negative interest rate?

- Why are so many people talking about negative interest rates?

- What are some explanations for why we could have negative interest rates?

- Why would an investor ever buy a bond with a negative yield?

- What are potential advantages of negative yields?

- What are the potential problems associated with negative yields?

What is a negative interest rate?

A negative interest rate is when a saver pays to have an entity hold his or her money (Table 1). In other words, the saver is paying interest and will receive less money back than he or she originally deposited. A negative interest rate is when a borrower is paid to borrow money. The borrower receives interest payments.

TABLE 1

| Saver A | Saver B | |

| Savings Account Yield | -1% | 2% |

| Initial Deposit | $1,000,000 | $1,000,000 |

| Year 10 $ in Account | $904,382 | $1,218,994 |

For illustrative purposes only. Performance is not guaranteed.

Why are so many people talking about negative interest rates?

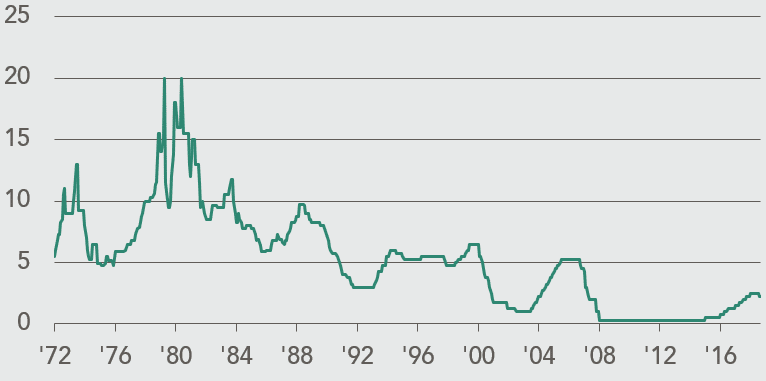

Prevalence – Worldwide, there is approximately $16 trillion of bonds (Chart 1) that have a negative yield. For example, if you buy a 10-year German Bund and hold it to maturity, you are locking in a guaranteed loss of -0.7% per year.

CHART 1: Bloomberg Barclays Global Aggregate Negative Yielding Debt (MLNS)

Source: Bloomberg. For illustrative purposes only. Data through Aug. 22nd, 2019.

Recent Trend in the U.S. – Over the past year, the yield on the 10-year UST has been cut in half. In November of 2018, the benchmark bond was yielding over 3.2%. In the past few weeks, it’s been yielding closer to 1.5%. If the yield could drop 1.7 percentage points over the past nine months, why couldn’t this rate of decline continue over the next year? Are we so different from Europe and Japan?

Fear – We’re not used to the idea of paying to save. We don’t know how this would work and that’s scary. And, maybe, there are reasons to legitimately be scared.

What are some explanations for why we could have negative interest rates? (Realize that many of these various explanations are related.)

Market Forces – It’s very difficult to have positive interest rates if the rest of the developed world has negative rates. Imagine investors had two choices: a 10-year UST bond yielding 10% and a 10-year German Bund yielding -1%. I would expect investors from around the world to buy the UST bond (and sell the German Bund). The buying pressure on the UST bond would push the price up and the yield down. The selling pressure on the German Bund would push the price down and the yield up. If these two bonds are considered to be close (but not perfect) substitutes, their yields would need to be closer. In effect, this means that negative yields from around the world are pressuring our yields lower at home.

An Appreciating Currency – If UST rates are higher than sovereign rates of other developed nations (as described above), foreign investors will want to buy our bonds. This would require them to sell their currency and buy U.S. dollars, causing the dollar to appreciate as a result. (In reality, the currency appreciates in anticipation of these transactions, simply because our interest rates are higher.) A stronger dollar makes it more difficult to export (we need to charge foreigners more for our goods since they are now paying with their weak currency). A strong dollar also makes imports cheaper and this hurts our domestic producers (if they are competing with imports). In addition, U.S. multinational companies that have overseas earnings will translate those earnings back to dollars at unfavorable rates (they will be worth less). In short, an appreciating currency has some unpleasant effects, and the result is that it creates pressure on the Fed to push rates closer to the rates in Europe and Japan. Lower rates could stop our dollar from appreciating.

A Slowing U.S. Economy – The 10-year UST bond yield tends to be correlated with the nominal growth rate of the economy. As fiscal stimulus wears off and our post-WWII expansion grows older, there is fear of lower real growth and lower inflation. The result is that yields go lower.

A Lower “Neutral Rate” – The neutral rate is a theoretical rate, not one that I can clearly see in the market. It’s the rate at which the FOMC could set the federal funds rate and this rate would result in monetary policy that is neither accommodative nor restrictive. In other words, it’s the rate at which Fed policy doesn’t help or hurt the economy. Economists believe that the long-term neutral rate is lower. This is because there are excess savings worldwide and weak demand to borrow. Greater savings may be occurring due to increased longevity as well as income inequality (more money in the hands of people who save rather than consume). If the neutral rate is low, this means that the FOMC has to take the Federal funds rate even lower than the neutral rate in order to stimulate the economy. This could include taking rates negative.

Central Banks Working in Conjunction with Governments – Many governments have far too much debt and positive interest rates will cause tremendous problems. Total U.S. debt is currently around 105% of GDP (and growing). If the U.S. government had to pay 3% on this debt, it would use up approximately 1/6 of their tax revenue. As debt increases, more and more of our tax revenue will be used to pay interest…unless rates are negative.

Why would an investor ever buy a bond with a negative yield?

Speculating on Even Lower Rates – If you buy a bond with a negative yield and rates go even lower, the bond price will increase.

TABLE 2: 10 Year Government Bond Yields

| Switzerland | -1.1% |

| Germany | -0.7% |

| France | -0.4% |

| Japan | 0.3% |

| United States | 1.5% |

| China | 3.0% |

| Brazil | 4.1% |

Source: Bloomberg as of Aug. 29th, 2019.

A Small Certain Loss is Better Than a Possibly Larger Loss – If you have a large amount of money, you may not be comfortable holding cash (due to theft or destruction or other loss). You may also not trust the banking system and the FDIC insurance may not be enough to cover the amount of cash you’re holding. As a result, a negative yield is simply the cost of protecting your capital.

A Positive Return From a Currency Forward Contract – Convert your dollars to euros, buy a negative yielding bond, but enter into a forward contract that allows you to lock in a stronger euro (meaning that you will convert your euros back into more dollars at maturity). In the right circumstances, this could turn your overall return into a positive number.

Borrow Short-Term and Invest Longer-Term – Investors can borrow short-term (at low rates) and invest in longer-term bonds at high rates (or less negative rates). Of course, if rates increase, the investor could lose.

Stay up to date

Subscribe to receive our quarterly investor letters and market updates.

What are some of the possible advantages of negative rates?

Signal Fed Intent – Negative rates may signal that the central bank is willing to do whatever it takes in order to support the market.

Increase Inflation Expectations – Low rates could encourage borrowing to stimulate the economy. In addition, negative rates mean the real rate of interest is particularly low. If the inflation rate is positive and the interest rate is negative, the real rate of interest is even more negative than the nominal rate of interest. In other words, if the interest rate is -1% and inflation is 2%, the real rate of interest is -3%. That is very cheap money.

Reduce the Attractiveness of Holding Money – Low rates may encourage spending. Of course, that substitution effect may be offset by the income effect (if I’m earning less interest, I need to save more in order to reach my goals).

What are the potential problems with negative yields?

Savers Are Punished – If you go back to the late 1990s, a retiree who had saved $1 million could buy U.S. Treasury bonds and earn $60,000 or more per year. Fast forward twenty years and that same retiree is earning approximately $20,000 per year. If rates go negative, the saver earns nothing on her capital.

Investors May Need to Save More – While most people discuss the substitution effect (that investors will move into riskier assets), investors also need to save more because lower interest rates prevent them from reaching their goals (the income effect). This could weaken demand.

Strange Penalties May Exist – If you pay early, should you have to pay more? You’re giving me money sooner and that money has a cost! Will my credit card company pay me interest on my outstanding balance?

People Will Take Action to Avoid Negative Rates – People will find it cheaper to pay for a safe-deposit box. Or, if rates become too negative, a new type of bank may start – one that is simply a safe, guarded by a private militia, charging a lower fee than normal banks may be charging. If the government wants to prevent this, paper currency will need to be eliminated. If all money is electronic, the government can impose negative rates as an automatic tax.

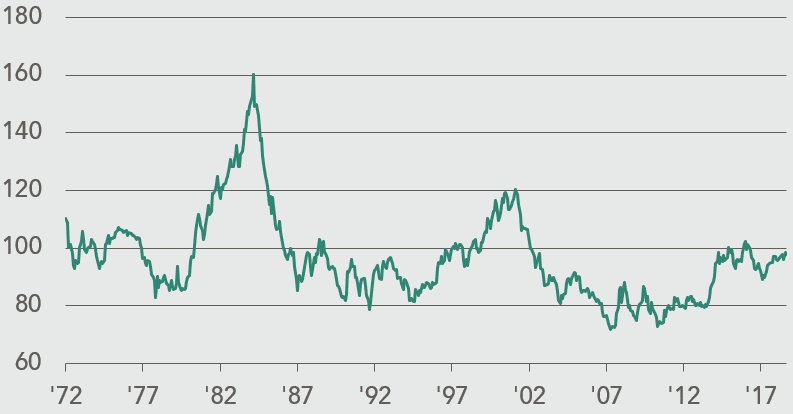

Negative Signal About the Economy – The FOMC lowers rates (Chart 2) in order to stimulate the economy. At some point, this smacks of desperation.

CHART 2: U.S. Federal Funds Target Rate (%)

Source: Bloomberg. Data through Aug. 23th, 2019.

Truly Out of Bullets – For many years, the Fed has worried about being too close to the zero-lower bound (the idea that they didn’t want to take the Fed funds rate below zero). If they do go below zero, at what point will they say enough is enough and not be able to lower rates any further?

Banks “Spread Business” is Injured – One way that banks profit is by borrowing money at low rates (often short-term) and loaning the money out at a higher rate (often for a longer term). Will depositors accept negative rates? If depositors won’t accept negative rates, the spread between banks’ cost of funding and loan rates will be compressed.

Insurance Companies Model Breaks Down – Insurance companies charge premiums, invest that money (float), and then pay claims. To the extent that insurance companies can’t earn positive returns from bonds, the cost of insurance becomes much greater. In addition, as discussed below, the present value of any distant liability becomes much greater. Insurance companies may also be forced to take more risk.

Pension Liabilities Explode – Many governments (local, state, and federal) and businesses have promised to make payments to workers when they retire. The present value of these liabilities becomes much greater when the discount rate is lower. Think of it this way: if you have been promised $60,000 per year during retirement, isn’t the value of that much greater to you when interest rates are zero as opposed to 10%? If interest rates were 10%, you could generate $60,000 per year if you had $600,000 and you would never reduce your principal. If interest rates are zero, you will need much greater funding and you will be reducing your principal with each $60,000 payment.

Portfolios Become Riskier – When rates of return are unattractive, investors reach for yield. This means they invest in riskier assets. This works fine…until it doesn’t. When there is a recession, these riskier borrowers have real problems.

Weaker Companies Stay in Business – As investors reach for yield, they fund weaker companies. In normal times, the cost of funding may have been too high, and these companies would have failed. Economists refer to the failure of these businesses as creative destruction, meaning that assets (such as workers) are released and go work at more productive companies.

Negative Rates Haven’t Been Particularly Effective – Europe and Japan have had negative rates for many years. They are not growing at high rates. Of course, we don’t know the counterfactual – how they would be doing if rates were positive. Regardless, we don’t aspire to be Japan or Europe.

Money Market Instruments Break the Buck – Institutional money markets offer variable rates. If they are investing in money market instruments with negative yields, the investor’s principal loses value.

Legal Issues Could Arise with Variable Rate Loans – Did the parties consider the possibility of negative rates when they entered into their contract? Is the lender ready to make payments to the borrower?

Negative Rates May Signal Deflation – Negative rates may serve as a signal that the Fed is overly concerned about low inflation. As consumers start to anticipate deflation, it can become self-fulfilling. Inflation expectations are the basis of how companies set prices and wages.

Sign of Fear – Investors are so nervous about the future, that they are willing to accept a negative rate.

Sign of Excess Capital – There is such a glut of capital that savers can’t earn a positive return without taking excess risk.

A Sudden Increase in Yields Could Be Painful – The price of a low interest rate bond is more sensitive to a 1% change in yields than the price of a higher interest rate bond. In addition, if investors buy longer-term bonds and riskier bonds, losses could be great.

Low Rates Could Appear To Be Part of a Currency War – President Trump has made clear that he wants a cheaper dollar. Negative rates at a time when the U.S. economy is growing may appear to have other motives, particularly while we are engaged in a trade war.

CHART 3: U.S. Dollar Index Spot

Source: Bloomberg. Data through Aug. 23rd, 2019.

Closing Thoughts

We are still a decent distance away from negative rates in the U.S. With that said, the gravitational pull of European rates is significant and the resentment for a stronger dollar is great. One meaningful economic shock could push our rates into negative territory. If we get there, the world won’t end and not every possible bad event (listed above) will occur. But, it also won’t be pleasant for many of us.

One of the biggest problems we face is the fact that we seem to have an unrealistic expectation of how fast our economy should be growing. Our expectations are anchored to historic growth rates that are very unlikely to repeat. Future growth will be determined by the growth rate of our labor force (which is slowing) and our productivity growth. The sooner that we get used to these lower expectations, the sooner we’ll stop thinking that our current growth is disappointing and that we need to stimulate the economy.

Sandy Leeds, Department of Finance – The University of Texas at Austin, McCombs School of Business

Information contained herein has been obtained from sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. Portfolio holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. All charts and tables are provided for illustrative purposes only. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC.