“Mountaintops inspire leaders, but valleys mature them.”

~ Winston Churchill

Today’s investment environment presents an entire set of paradoxes. Interest rates are rising further while inflation measures have started to decline. Oil prices are climbing rapidly akin to post-World War II conditions indicating we are headed towards a recession. Small cap stocks have declined 30% over the past two years implying we are in a recession. Housing prices are increasing in tandem with interest rates, while commercial real estate prices are collapsing similar to 2008. Articles comparing today’s investment landscape to 1987, 2007, and other points of maximum pessimism pervade news headlines.

It is a futile endeavor to prognosticate about the short-term path of markets. The growing unease is not lost on us, but we believe that the right investment temperament creates opportunities for building generational wealth. Our time horizon is in years and decades, not quarters or months. The volatility of public equity markets that creates apprehension for most participants is the exact reason we have a significant advantage: opportunistic investing requires prioritizing controllable factors, and then taking risk when others won’t and reducing risk when others aren’t.

Our focus and priority, regardless of macro conditions, centers on three key factors:

- Identify high-quality management teams who are exceptional capital allocators and focused on shareholder value

- Identify businesses with unique assets that are market leaders and whose balance sheet gives them flexibility

- Buy or sell businesses at extreme valuation levels when sentiment and volatility create opportunity

Our investment success over the past 15 years can be attributed to these three factors. We can’t control interest rates, commodity prices, or macro environments, but we can stay true to this discipline.

When we invest in a business, we are entrusting the CEO to make decisions that will deliver shareholder returns in the long run. To do this effectively, we must analyze human behavior and personality characteristics to build a mosaic about this individual’s priorities. We believe that understanding who is running the business is just as important as what the business is, and there is a certain blueprint of leadership qualities that we seek to identify.

Three types of leadership qualities we look for:

- Level 5 Leaders as described by Jim Collins

- How Champions Think as described by Dr. Bob Rotella

- The Hate-to-Lose Mindset as described by Eddie Reese

Level 5 Leadership

Jim Collins developed the concept of Level 5 Leadership when writing the must-read book, Good to Great. The Level 5 CEO puts mission and company ahead of ego, power, and fame. Collins describes them this way:

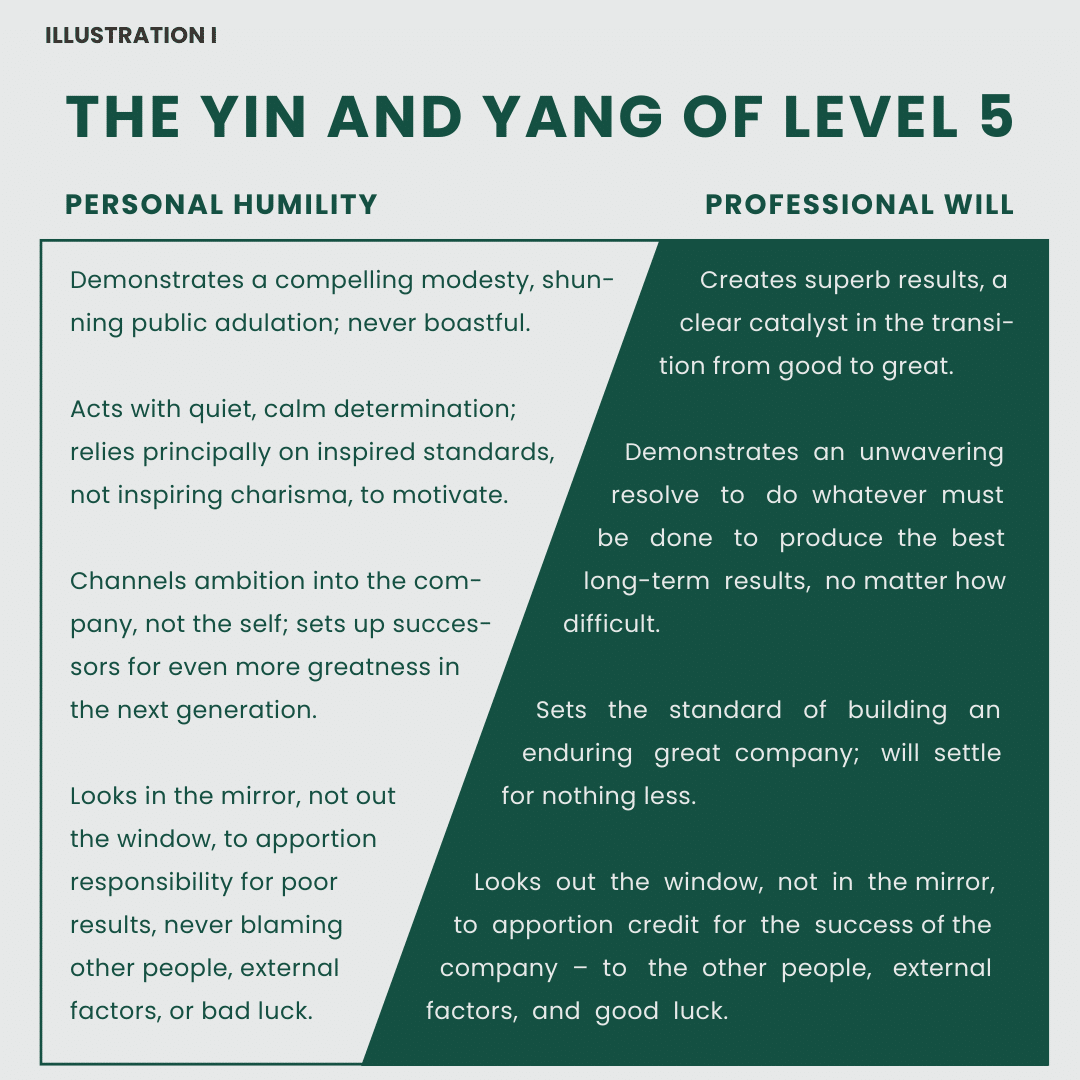

Level 5 leaders display a powerful mixture of personal humility and indomitable will. They’re incredibly ambitious, but their ambition is first and foremost for the cause, for the organization and it purpose, not themselves.

Source: Harvard Business Review

Illustration I highlights the way Level 5 CEOs balance their humility versus will, and their ability to put the organization above self. We want to align ourselves with CEOs who operate this way, because when a transformational CEO is hired to run a good business, great things can happen. Dara Khosrowshahi, the deliberate CEO of Uber, is a perfect example of this. He summed it up in a NY Times interview:

“My goal in life is not to build the most sexy company. It is to build the best company.”

How Champions Think

The championship mindset is described in detail by Dr. Bob Rotella in his insightful book, How Champions Think. Dr. Rotella has worked with some of the greatest competitive athletes (think Lebron James) throughout his successful career as a sports psychologist and coach. He gives the reader a unique insight into the competitors’ mindset and how they sustain through difficult environments and thrive under pressure. Collins and Rotella name some of the same character traits for Level 5 leaders and top competitors: positive, enduring, confident, and self-aware to name a few.

Source: How Champions Think

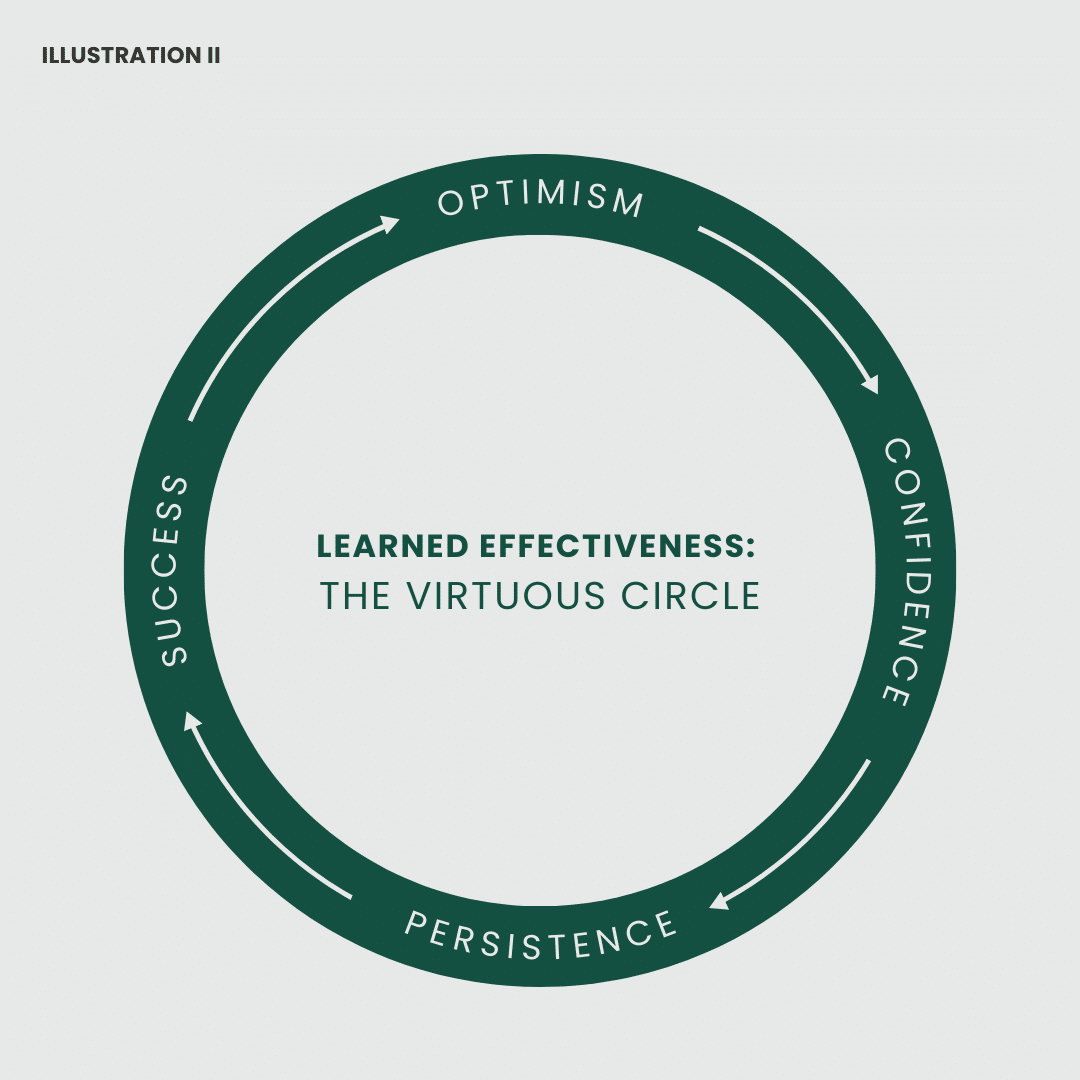

One interesting concept Rotella examines is the virtuous cycle of “learned effectiveness” (Illustration II). He writes:

…it’s more helpful to think of a virtuous cycle at work in the minds of exceptional people. They have optimism and confidence. Because they are optimistic and confident, they react to setbacks not by getting discouraged and giving up, but with persistence. (…) Because they persist, they get better. Because they get better, they experience success. And that success reinforces their optimism, their confidence, and their respect for their own talent. That’s the virtuous cycle.

It takes a certain type of person to be able to use difficult environments as motivation to improve and stay focused. When performing our due diligence, we look at how a CEO describes their actions before, during, and after a crisis. Gary Friedman, the charismatic CEO of RH, had this to say in the middle of the pandemic:

What times like these also require is a clear and compelling vision, one that unites and ignites us. It’s easy in times of turmoil to lose sight of long term strategies when you’re dealing with short term distractions, and it’s critical that we stay focused on our long term narrative as we navigate through the short term noise. We are convinced that the current environment does not change our long term vision and strategy.

The ideal leader is always anticipating, not reacting, and keeps their team focused on the task at hand while being rationally optimistic in their endeavor.

Hate-to-Lose Mentality

Eddie Reese is the head coach of the University of Texas men’s swimming team. During his 45-year tenure he’s accomplished the following:

- 15 National NCAA Championships

- 8-time NCAA Coach of the Year

- 44 conference championships in a row

- 3-time head coach of U.S. Olympic men’s swimming team

- Coached 35 Olympians who have collected 44 gold medals, 16 silver medals, and eight bronze medals

Ken Willis summed up the magnitude of Reese’s success when he said, “He’s won as many NCAA national championships as Nick Saban, Bear Bryant and Bobby Bowden…combined.”

Reese’s leadership traits resemble those cited by Collins and Rotella. He communicates and motivates effectively through observation and listening to his swimmers. He also understands winning is not only about hard work, but also “self-image and enjoyment.” Reese attributes some of his success to how he analyzes a swimmer’s attitude, particularly in how they handle winning or losing. He said the following:

If you take 100 percent of the good swimmers in our country, 80 percent like to win….20 percent hate to lose. All but one person on every Olympic team comes from the hate-to-lose group. That doesn’t mean they don’t lose, but that’s so different than wanting to win.

Reese has experienced tremendous success by holding a group of “hate-to-lose” individuals accountable at a team level. We seek to invest with executives who approach their team the same way. Individuals in this category hold themselves to a different standard. Bill Foley, Chairman of Fidelity National said it best:

I believe if you tolerate mediocrity, your business is going to be mediocre. I don’t tolerate it.

Closing Thoughts

These leadership traits are just a starting point and framework for analyzing management. Public equity investing requires a level of trust in management’s ability to navigate different situations on our behalf as shareholders. We have no control over how management will approach complex situations but want them steadily marching forward towards an achievable and easily articulated goal. It’s easy to be swayed by CEOs who sell disruption and radical objectives, but the best managers lead their companies steadily towards the finish line. Jim Collins sums this approach up best:

Financial markets are out of your control. Customers are out of your control. Earthquakes are out of your control. Global competition is out of your control. Technological change is out of your control. Most everything is ultimately out of your control. But when you 20-Mile March, you have a tangible point of focus that keeps you and your team moving forward, despite confusion, uncertainty, and even chaos.

We want to walk alongside management teams that understand their tangible point of focus. We know what ours is and appreciate you entrusting us as we march forward.

The Nixon Capital Team

Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. Information contained herein has been obtained from various sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any reliance placed on opinions and assumptions herein is done at your own risk. Nixon Capital has not reviewed any of the websites that may be linked to this letter and is not responsible for their content. Nixon Capital is not responsible for the privacy practices of such other websites. Discussions of individual securities are intended to inform shareholders as to the basis (in whole or in part) for previously made decisions by the firm to buy, sell or hold a security in a portfolio. References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security. Portfolio holdings and asset allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC.